COVID-19 and Your Mortgage

Learn about your options today!

Welcome to the April issue of my monthly newsletter!

As your dedicated Dominion Lending Centres mortgage broker, I am happy to help guide you through the current climate amidst the COVID-19 pandemic. I understand that things can be stressful but I am here to help!

In order to mitigate the financial strain on your family, the Canadian government is offering a variety of options to individuals affected by COVID-19. Some of these options include additional GST credit support, a $2,000 monthly Canada Emergency Response Benefit, student loan deferral and mortgage deferral for up to six months. Visit the Dominion Lending Centres dedicated website for more information about COVID-19: https://dominionlending.ca/covid-19

As your mortgage professional, I want to provide you with detailed information regarding mortgage deferral and your options during this time. Please find some helpful insights below!

Thanks again for your continued support and referrals!

To Defer or Not to Defer

With Canada’s major Mortgage Finance Companies (MFC’s) and all six big banks offering mortgage deferrals of up to 6 months, as well as case-by-case options from credit unions, one of the major questions currently facing Canadians amid COVID-19 is do you defer your mortgage? To help you with this decision, we have gathered some important information on what it means to defer and the benefits (or side-effects) from doing so.

For anyone who is unsure, a mortgage payment deferral means that customers are not required to make regular payments (principal, interest and property tax, if applicable) on their mortgage. In the case of COVID-19, this deferral period can be up to six months.

As much as you may be keen on taking advantage of deferring your mortgage, it is essential to remember that this is not “free money”. During the time mortgage payments are deferred, it is important to understand that interest will continue to accrue and will be added to the mortgage account balance at the end of the deferral period. That said, depending on your financial situation, this may be a great option for those individuals who are facing lower monthly income due to COVID-19.

When deciding whether to defer, I recommend you have an honest conversation with yourself about your financial situation.

- Have you lost monthly income due to COVID-19?

- Are you struggling to pay your monthly bills as a direct result of COVID-19?

- Are you finding yourself extra stressed about your finances?

Remember, deferring payments is as much an emotional and mental decision as it is a financial one. In most cases, if you are really stressed and struggling then deferral is the way to go as it will help free up some income right away for families with reduced or no monthly income due to COVID-19.

To give you a rough idea of the true cost of deferral, RBC Bank has put out a great ‘ Skip a Payment ’ tool to help you understand how deferring your payment will work. This calculator will show you the amount owing after any deferred payment(s) to give you an idea of how affordable it may be for you. For example, if you have a mortgage rate of 2.80% and 20 years remaining, a single skipped payment of $2,000 will cost you an extra $1,403 over the long-term. Depending on your financial situation and regular monthly income, deferring your mortgage for six months might be a no-brainer for you – especially if it opens up your current finances for other bills.

If you are leaning towards deferring, please book your virtual appointment so we can go over your unique situation and I can help explain the costs to you and determine if it is the right option! If deferring is right for you, contacting your lender to apply and take advantage of this offer will be the next step. Ensuring you have approval for deferral will prevent any impact on your future credit rating.

Lock-In or Stay Variable?

Whether you already have a mortgage or are looking to get your first mortgage amid COVID-19, there are some things you should know regarding fixed and variable rate mortgages during this time.

If you currently have a mortgage, you may have heard on the news about interest rates rising and you may be unsure of where you stand. It may seem confusing, but when it comes to mortgage rates and interest we are seeing things moving in both directions – rates are going up and going down simultaneously. Depending on the mortgage you currently have (fixed or variable) you may be experiencing different effects with regard to COVID-19 and may be unsure where you stand. Here are some things to know:

Variable Mortgages

Variable rate mortgages, which represent 1 in 4 mortgages in Canada, are driven by the Bank of Canada’s overnight lending rate. Having a low variable rate may lead you to have some concerns surrounding the increasing mortgage rates in the country and where that leaves you.

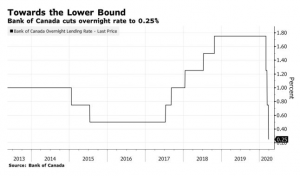

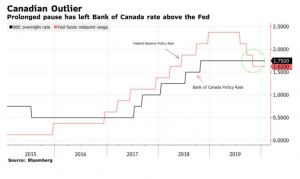

The Bank of Canada has already made several cuts to the bps rate for a full 1% drop. It is important to understand that these cuts to the overnight lending rate actually get passed down to variable mortgage rate holders – unlike for fixed rate mortgages.

If you currently have a variable rate mortgage you most likely already have a discount from prime. As a result, you may have already seen your rates decrease and you may now be sitting around 1.85% to 2.2% variable interest currently. You may be concerned about these rates rising again but the good news is that it is unlikely that you will see significant rate volatility or increases in interest rates on a variable mortgage.

A mortgage professional can help assess your particular financial situation and mortgage, but most variable-rate mortgage holders will benefit the most by not doing anything with their mortgages at this time as the rates are expected to remain low and possibly even decrease.

Fixed Rate Mortgage

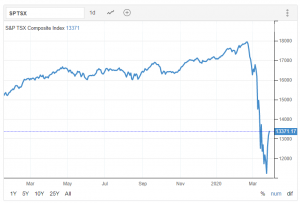

Many Canadians are currently locked into a five-year fixed rate mortgage and these individuals are currently seeing a different trend with their mortgage. To help you understand this further, it is vital to recognize that fixed rates are typically linked to the bond market in Canada, as opposed to the Bank of Canada which is the driver for variable-rate mortgages. Therefore, you can have the bond market and Bank of Canada doing two separate things resulting in both an increase and a drop in interest rates, depending on which rate type of interest you hold.

If you are one of the many Canadians with a five-year fixed-rate mortgage, you are likely seeing your interest rates increasing due to the resulting turmoil in the stock and bond markets. The changing market is resulting in a pull-back from investors who don’t want to lend out funds at such low rates. In addition, with the COVID-19 mortgage relief options, banks are seeing a very large increase in demand for mortgage products and inquiries. This is continuing to drive demand with no increase in supply, which also results in rate increases.

If you are currently in a fixed-rate mortgage, it is important to understand your options and how long they expect rates to be increased. If you are considering converting your fixed-mortgage to a variable-rate mortgage, you will likely have a 3 month payment penalty. Depending on your mortgage amount, this may be a small price to pay for a lower interest rate for the foreseeable future. I would be happy to discuss this with you to guide you to the best decision for your financial situation and capacity.

New Mortgages

If you do not have an existing variable or fixed mortgage and are in the process of getting a new mortgage, refinancing or renewing you may be wondering what to do. While mortgages will vary on a case-by-case basis, the current consensus from mortgage professionals is that a variable-rate mortgage will be the way to go, especially if you can get a discount on prime that puts you around 2%. While there is talk of mortgage rates increasing, the impact to a variable-rate mortgage is likely to be minimal (if at all).

Tips for Social Distancing & Staying Safe From Home

Stay Safe. Stay Home. Save Lives.

This is currently the motto for Canadians who are working hard across the country to combat COVID-19 by staying home – including your mortgage brokers! While social distancing of this magnitude has never occurred previously, it is important to understand that we are all in the same boat. To help you get through this period, I have put together some tips for social distancing and staying safe (and proactive!) at home:

- Follow Best Practices:

Ideally, to make social distancing most effective, individuals are only interacting with their household during this time and until the pandemic is under control. Some other best practices include:- If you have to go out and restock your pantry or get supplies, try to only go out once per week.

- Be mindful of other consumers; do not overstock.

- If you are out in public, be sure to stay at least 6ft away from other individuals.

- On walks, do not let your dogs say ‘hi’. They will forgive you, we promise.

- Maintain Your Routine:

When the world feels like it is going crazy, one of the best things you can do to keep your sanity is to maintain your routine. Whether you’re out of work or working from home, making sure that you continue to get up at your normally scheduled time and go through your morning process is a great way to maintain stability. Taking your regularly scheduled breaks, such as lunch hour, while working from home are also important to maintain your schedule (and keep sane). Be sure to continue to maintain social distancing procedures during this time. - Get Up and Move:

It can be hard to feel motivated, but it is important to make sure to get up and get moving when you are able. From a home workout to a walk, everything works towards keeping your body and brain healthy; especially during times of extra stress. Carve out 15-60 minutes per day for some light physical activity and you will be amazed at how much better you feel! - Connect With Others:

In today’s world, we have a plethora of technology at our disposal. Even if you feel alone, there are ways to reach out to friends and family through Skype, Houseparty, Zoom Meetings, e-mail, text and an old fashioned phone call. While it is vital to maintain physical distance, we as humans require connection so be sure to utilize the tools around you and don’t be afraid to share your feelings – your friends are all in the same boat and will understand. - Stay Informed:

Information is power and the more information you have at your disposal as this situation develops, the better prepared you will be to manage your household and finances. Dominion Lending Centres dedicated COVID-19 website is a great resource for staying up to date: https://dominionlending.ca/covid-19/